Are you ready to navigate the volatile skies of the stock market and decipher the trajectory of American Airlines Group Inc. (AAL)? The fate of AAL, a titan of the global aviation industry, is intricately linked to a complex interplay of financial performance, strategic decisions, and the ever-shifting landscape of the travel sector.

The world of finance, particularly the realm of stock trading, demands a constant vigilance, an unwavering commitment to staying informed. It's a domain where fortunes can be made or lost on the basis of split-second decisions, influenced by news cycles, market sentiment, and a deep understanding of the underlying fundamentals. For those contemplating a stake in American Airlines Group Inc. (AAL), a comprehensive grasp of the airline's current standing, its historical performance, and its future prospects is not just advisable it's absolutely essential.

To further illuminate the context around the challenges and the opportunities surrounding AAL, consider the factors influencing the airlines performance, including the influence of external events like shifts in global economies, the fluctuations in fuel prices, and the evolving travel behavior.

American Airlines, as a publicly traded entity, is subject to rigorous scrutiny. Investors and analysts alike pore over its financial reports, looking for clues to its future direction. The company's stock price, a key indicator of its perceived health, responds in real-time to news, market trends, and the decisions made by its leadership. The following table summarizes the key statistics for the stock of the company:

| Metric | Value |

|---|---|

| Stock Symbol | AAL |

| Exchange | NASDAQ |

| Industry | Airlines |

| Market Capitalization | (Data available on financial websites like Yahoo Finance, MarketWatch) |

| 52-Week Range | (Data available on financial websites like Yahoo Finance, MarketWatch) |

| Earnings Per Share (EPS) | (Data available on financial websites like Yahoo Finance, MarketWatch) |

| Price-to-Earnings Ratio (P/E) | (Data available on financial websites like Yahoo Finance, MarketWatch) |

| Dividend Yield | (Data available on financial websites like Yahoo Finance, MarketWatch) |

| Debt-to-Equity Ratio | (Data available on financial websites like Yahoo Finance, MarketWatch) |

Source: Nasdaq.com - (Note: Values are placeholders; actual data should be obtained from reputable financial sources.)

The latest American Airlines stock prices, alongside a constant stream of news, are readily available. Investors can delve into a wealth of information, from stock quotes and historical data to insightful analyses designed to empower them. The value of staying well-informed, in this climate, cannot be overstated. Armed with the right tools, one can attempt to make informed decisions, increasing the chances of successful trading and investment outcomes.

- The Enduring Career And Enigmatic Persona Of Timothy Olyphant

- The Life And Career Of Lorna Watson A Renowned Actress

American Airlines' financial health is subject to constant scrutiny. The company, like all major airlines, carries an immense debt load, a fact that plays a significant role in its overall financial stability and its stock performance. The weight of this debt, coupled with the unpredictable nature of fuel costs and other operational expenses, creates a complex financial environment.

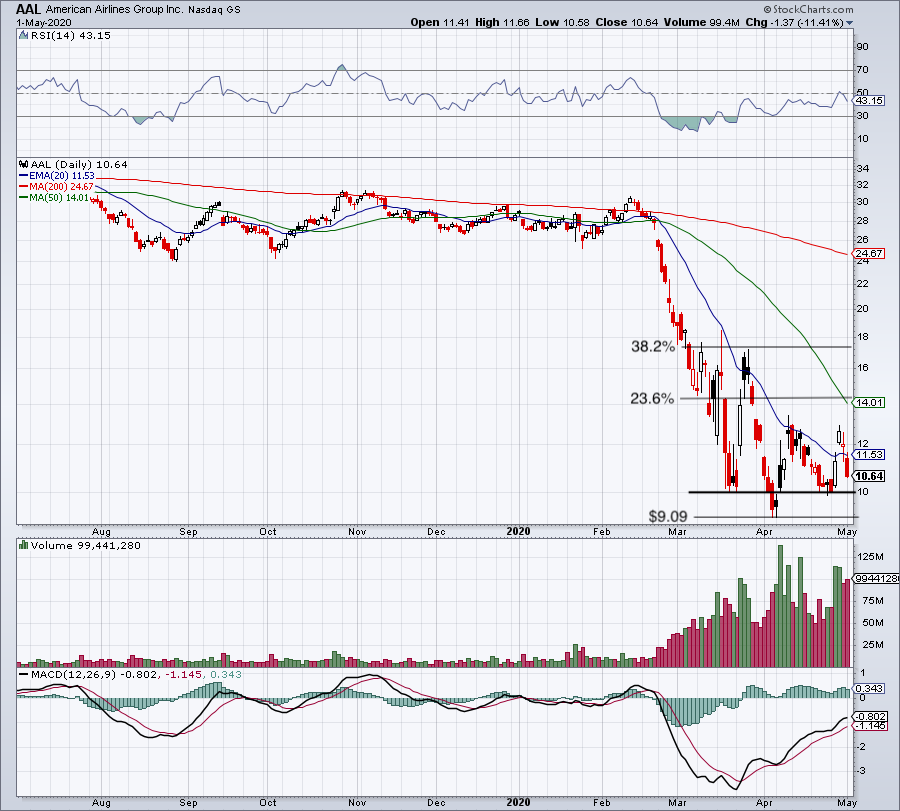

Market dynamics are constantly evolving, and for those trading in AAL stock, timeframes will vary depending on the investor's strategy. Whether you are aiming for the short term profits with a "Bearish breakdown trade" strategy, or have your focus set on a longer timeline, it is crucial to have clear goals and plans in place. Bearish breakdown trade plans involve short positions, with invalidation levels and profit targets.

The stock market is known for its volatility. This characteristic is also shared by AAL. The market reacted with a significant drop after the Q4 earnings report on January 23, 2025. Even though the company surpassed analysts' expectations for revenue and earnings, the stock price responded negatively. The drop was associated with a softer outlook for 2025 EPS.

Despite the immediate negative reaction, it's crucial to analyze the historical context. Despite the drop, AAL stock has shown positive gains over the past periods. This underscores the importance of considering long-term trends and the overall financial performance, rather than focusing solely on short-term fluctuations. An understanding of historical trends will provide an advantage in decision-making.

The market is a place for a diverse set of ideas and insights. It's not just about tracking prices. Engaging with the community is an essential part of the process. Traders and investors can participate and share their ideas and gain insights from other like-minded individuals.

American Airlines Group Inc. (AAL) provides an opportunity to view investment information. Information is available to help you make informed decisions. It's possible to view the stock information with charts, news, and other key data.

American Airlines' position as the world's largest airline by aircraft, capacity, and scheduled revenue makes it a significant player in the global travel landscape. The size and scope of its operations require investors to study a diverse set of data points.

Tracking AAL's price will bring financial insights. Investors can review historical data and analyze the information to make more informed choices. There is also available data on price forecasts to empower the investing journey.

To make informed decisions, investors need access to the most current data available. Data can be found on many platforms. Consider the common stock (AAL) stock quotes and trades.

A deep understanding of the past will provide you with information about the future. The analysis of all available data will help to navigate the complexities of the market. Interactive charts are designed for this purpose, and there are a range of indicators available.

American Airlines is continually making adjustments to its business model to remain competitive. Fuel costs, labor negotiations, and the overall state of the economy are just a few of the elements influencing its bottom line. The company is committed to adapting and innovating.

The aviation industry is highly competitive, and American Airlines is involved in an ongoing process of managing this situation. This includes managing its fleet, route networks, and pricing strategies. The company must manage these elements to grow its profitability.

Analyzing the financial standing of the company is essential, including financial statistics and trading records. Investors should be equipped with the tools to make informed decisions.

The airline industry is subject to change and shifts in economic trends. The ability of the industry to adapt to these changes will determine its future. For investors, this means understanding the long-term trends.

The aviation business, like any other, is complex, and many factors will impact your trading strategies. Thorough research is essential.

- The Ultimate Guide To David Caruso Unraveling The Mystery Of His Ekthefelle

- Unraveling The Bond Odell Beckhams Brotherly Connection Unveiled