Is the quantum computing revolution poised to reshape the financial landscape, and if so, what does the future hold for investors eyeing companies like IonQ? The quantum computing industry is not just emerging; it's accelerating, with market valuations projected to explode in the coming years, offering potentially transformative returns for those who position themselves strategically.

The quest to understand the future of quantum computing, particularly its impact on stock valuations, necessitates a deep dive into the current market dynamics and the projected trajectory of key players. As we approach the mid-2020s, the quantum computing sector stands at a pivotal juncture, with technological advancements rapidly intersecting with burgeoning investor interest. This convergence is particularly evident in the fluctuating stock prices of companies like IonQ, a leader in the field.

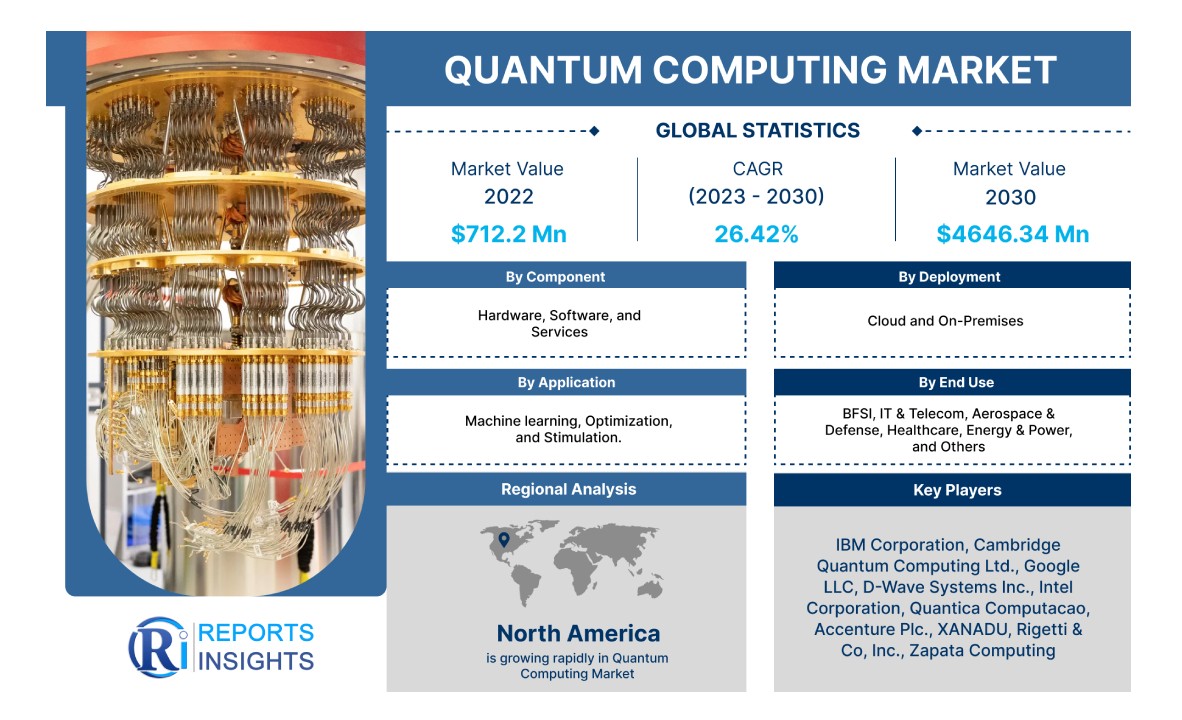

In 2021, the global quantum computing market was valued at approximately $470 million. Yet, the projected growth is nothing short of astonishing. Recent research suggests that the market could surpass $1.7 billion by 2026, a testament to the exponential expansion anticipated in the sector. This explosive growth fuels the interest of analysts, prompting them to revise price targets for key players like IonQ, reflecting the sector's evolving potential.

- The Ultimate Guide To Peso Pluma Height Discover The Perfect Fighting Weight

- Antonio Banderas Exploring His Captivating Childhood

The surge in investor interest is not solely based on theoretical promise. Recent developments, such as Google's unveiling of its Willow chip, have further ignited enthusiasm. This chip, a significant advancement in quantum hardware, has bolstered confidence in the industry's future, translating into increased investor activity and market volatility.

IonQ, as the first pure-play quantum computing company to trade publicly, presents a unique opportunity for investors. Its stock performance and future prospects are therefore of significant interest to market analysts and potential investors alike. The company's ability to innovate and capitalize on the emerging quantum computing market will play a crucial role in its stock price trajectory.

Understanding IonQ's role in this evolving landscape requires a comprehensive assessment of various influencing factors, including market trends, technological advancements, and competitive dynamics. The following sections will delve into stock price predictions for IonQ, analyzing factors from 2024 through 2050, to help paint a clearer picture for investors.

- Unveiling The Net Worth Of Renowned Actor Josh Lucas

- The Age Gap Between Hugh Jackman And Deborralee Furness A Deeper Look

Before we go further, we must note that on the last trading day of the week, April 25th, 2025, IonQ's stock price saw a gain of 2.74%, rising from $6.94 to $7.13. This marked the fourth consecutive day of gains, generating a buzz in the market. The trend, however, is just starting. It will be interesting to watch if IonQ maintains this upward momentum or experiences a pause. These short-term gains highlight the volatility and speculative nature of the market. More in-depth analysis can reveal the driving force behind the gain.

The quantum computing industry is rife with both opportunities and uncertainties. While the potential for advancements in AI is undeniable, the accuracy challenges within quantum computing remain. It is within this setting that Quantum Computing Inc. (Qubt) continues to be the subject of discussion.

Quantum Computing Inc. stock predictions remain uncertain, investors must consider all aspects of the sector.

A more comprehensive understanding of the sector and its players, including companies like Rigetti, is crucial for making informed investment decisions. Rigetti's projects related to national security and military technology make it a significant player.

Investors often turn to stock price targets to get an idea about a stock's valuation. Stock price targets represent the price at which analysts consider a stock fairly valued based on their projected earnings and historical trends. Currently, the expected price per share for Quantum Computing Inc. stands at $100.00. But investors must remember that such predictions should be reviewed alongside other research.

The market for cloud computing, by contrast, is forecast to reach a staggering $2.4 trillion by the end of the decade. While quantum computing's market size is smaller by comparison, its potential for disruption and exponential growth is what truly catches the eye of investors. A bold vision for 2050 has been proposed by many companies. Our analysis of the fundamentals, technical trends, and broader market outlook suggests that Quantum Computing Inc.s (Qubt) stock price could reach approximately $14.94 by 2025, $62.73 by 2030, $87.08 by 2035, $108.27 by 2040, and possibly $147.02 by 2050.

Understanding the quantum computing market and the factors that influence Qubt's stock price is vital. The forecasts provided offer a glimpse into what could be possible for the sector. Yet, interpreting these predictions and understanding the inherent risks is key for investors.

For Quantum Computing Inc.'s stock forecast for 2030 (5-year), an average quantum computing stock forecast of $4.41 is provided, with a high forecast of $4.75 and a low forecast of $4.12.